Learn how to organize your monthly bills and create a budget that works. Say goodbye to late fees and hello to financial freedom with these simple tips and tricks!

Are you tired of bill collectors haunting your dreams? Do you feel like your finances are a messy pile of papers?

Fear not, brave budgeter!

I’m here to help you become a bill-busting superhero, armed with the knowledge and tools to conquer those pesky payments and take control of your money.

Why Organize Your Bills? 🤔

Imagine your bills as a bunch of wild animals running amok in your house. Organizing them is like taming those beasts, putting them in their place, and making sure they don’t cause any trouble.

Here’s why it’s important:

- No More Late Fees: When your bills are organized, you’ll always know when they’re due and can pay them on time, avoiding those nasty late fees.

- Reduce Stress: A tidy financial life means less worry and more peace of mind. You’ll know exactly where you stand financially and won’t have to scramble to find bills at the last minute.

- Save Money: When you’re organized, you’re more likely to spot errors or overcharges on your bills, potentially saving you money.

- Track Your Spending: Organizing your bills makes it easier to see where your money is going and identify areas where you can cut back.

Bill Organization Superpowers 🦸

1. The Mighty Binder 📂

A binder is like a superhero’s utility belt, holding all your important financial tools. Use it to store your bills, receipts, and other financial documents.

You can create separate sections for each type of bill (e.g., utilities, credit cards, loans) or organize them by due date.

2. The Calendar of Destiny 🗓️

Mark your bill due dates on a calendar, whether it’s a physical one or a digital calendar on your phone or computer. Set reminders a few days before each due date so you have plenty of time to pay.

This way, you’ll never miss a payment again!

3. The Automated Payment Army 🤖

If you’re forgetful or simply want to make life easier, set up automatic payments for your bills.

This way, your payments will be made on time without you having to lift a finger. Just make sure you have enough money in your account to cover the payments.

4. The Digital Filing System 📁

If you prefer a paperless approach, create a digital filing system for your bills and receipts.

You can use cloud storage services like Google Drive or Dropbox, or dedicated apps like Expensify or Shoeboxed.

This way, you can access your financial documents from anywhere and keep them organized.

Creating a Monthly Budget: Your Financial Shield 🛡️

A budget is like a shield that protects you from overspending and financial stress.

It helps you track your income and expenses, so you can make informed decisions about your money.

1. List Your Income 💰

Start by listing all your sources of income, including your salary, any side hustles, or other sources of money.

2. List Your Expenses 💸

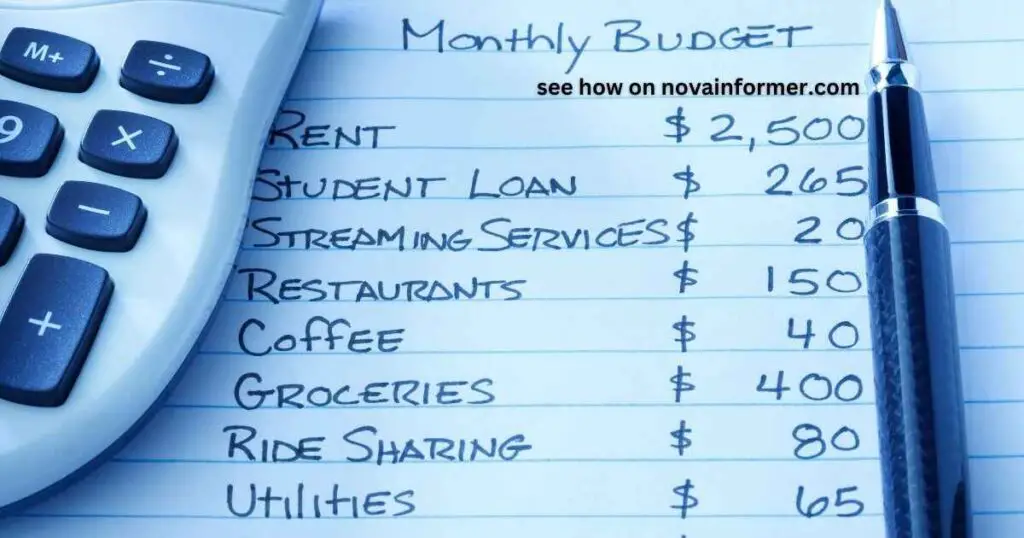

Next, list all your expenses, including both fixed expenses (like rent, mortgage payments, and car payments) and variable expenses (like groceries, gas, and entertainment).

3. Categorize Your Expenses 🗂️

Group your expenses into categories, like housing, food, transportation, utilities, debt payments, savings, and fun money.

This will help you see where your money is going and identify areas where you can cut back.

4. Set Spending Limits 🛑

For each expense category, set a spending limit based on your income and goals.

Be realistic and make sure your total expenses don’t exceed your income.

5. Track Your Spending 🕵️♀️

Throughout the month, track your spending to make sure you’re staying within your budget. You can use a budgeting app or simply keep a running tally in a notebook.

Example Monthly Budget Breakdown 💰

| Expense Category | Amount ($) |

| Housing (rent/mortgage) | 800 |

| Utilities (electricity, water, gas) | 150 |

| Food | 400 |

| Transportation | 200 |

| Debt Payments | 300 |

| Savings | 200 |

| Entertainment | 100 |

| Total | 2,150 |

Note: This is just an example. Your budget will vary depending on your income and expenses.

Tips for Bill-Busting Success 🦸♀️

Here are some tips to help you out:

- Pay Bills on Time: Avoid late fees and negative impacts on your credit score by paying your bills on or before the due date.

- Negotiate Bills: Don’t be afraid to negotiate your bills, like your cable or internet bill. You might be able to get a lower rate or a better deal.

- Consolidate Debt: If you have multiple debts with high-interest rates, consider consolidating them into a single loan with a lower interest rate. This can save you money on interest charges and make it easier to manage your debt.

- Set Financial Goals: Having clear financial goals will help you stay motivated and focused on paying off your debt and building a brighter financial future.

Take Note

By following these bill organization tips and creating a budget, you can take control of your finances and achieve financial freedom.

Remember, it’s a journey, not a race.

Start small, be consistent, and celebrate your victories along the way!