Calculate precise margin using our margin calculator.

Price and margin calculator – B2B sale

Use radio button to select calculation target

What is Margin?

In the dynamic landscape of business, understanding and managing margins is crucial. Margin represents the difference between the cost of goods sold (COGS) and the sale price. It’s a key indicator of profitability, allowing businesses to assess financial health and make informed decisions.

How to calculate profit margin

Profit margin is a fundamental metric, often expressed as a percentage, revealing the proportion of revenue that translates into profit.

The formula is straightforward: Profit Margin=(Net Profit/Revenue)×100

This metric provides valuable insights into operational efficiency, competitiveness, and sustainability.

Gross margin formula

Gross margin focuses specifically on the production cost of goods or services. The formula is:

Gross Margin=( Revenue−Cost of Goods Sold (COGS)/Revenue )×100

Understanding gross margin aids in assessing production efficiency and pricing strategies.

How to Use this Margin Calculator

The NoverInformer Margin Calculator simplifies complex calculations, making it an invaluable tool for businesses. Here’s a step-by-step guide:

Step 1: Input Bundle Price

Enter the total price for a bundle of units. This is a critical starting point for accurate calculations.

Step 2: Input Number of Units per Bundle

Specify the quantity of units included in each bundle. This data is crucial for determining unit prices and overall profitability.

Step 3: Input Unit Price or Sell Price

Choose whether to calculate based on unit price or sell price. Select the appropriate radio button to indicate the target number for calculation.

Step 4: Review Results

The calculator dynamically adjusts fields based on user input, providing real-time results for unit price, gross margin per unit, and percentage gross margin.

Margin vs. markup

While margin and markup are related, they serve different purposes. Margin is the percentage difference between cost and sale price, while markup represents the percentage difference between cost and the selling price as a percentage of the cost.

FAQ

What’s the difference between gross and net profit margin?

Gross profit margin assesses the profitability of production, excluding other expenses. Net profit margin considers all expenses, providing a comprehensive view of overall profitability.

Can profit margin be too high?

An excessively high profit margin may indicate overpricing or insufficient reinvestment in the business. Striking a balance is crucial for sustainable growth.

What is margin in sales?

In sales, margin reflects the proportion of revenue that contributes to covering costs and generating profit. It’s a key metric for evaluating pricing strategies.

How do I calculate a 20% profit margin?

Divide the net profit by revenue and multiply by 100. If the result is 20%, you’ve achieved a 20% profit margin.

What is a good margin?

A good margin varies by industry. Generally, a higher margin indicates better profitability. Compare your margin with industry benchmarks for a more accurate assessment.

How do I calculate margin in Excel?

In Excel, use the formula: [latexpage] \[ {Margin (\%)} = \left( \frac{\text{Selling Price – Cost Price}}{\text{Selling Price}} \right) \times 100 \]

How do I calculate a 10% margin?

Divide the net profit by revenue, and if the result is 10%, you’ve achieved a 10% profit margin.

Are margin and profit the same?

No, margin is a percentage, while profit is a monetary value. Margin assesses profitability relative to revenue, while profit reflects the actual amount earned.

How do I calculate a 30% margin?

Use the formula: Selling Price=Cost Price+(Cost Price×Margin (%))

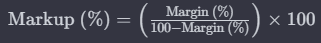

How do I calculate markup from margin?

Use the formula:

In Conclusion

Understanding and effectively managing margins are essential for businesses navigating the intricacies of financial success. The NoverInformer Margin Calculator empowers businesses to make informed decisions, optimize pricing strategies, and achieve sustainable profitability.

As markets evolve, utilizing tools that simplify complex calculations becomes increasingly valuable. Stay competitive, stay informed, and leverage the power of the NoverInformer Margin Calculator for strategic financial management.

credit:

by R-C (https://codepen.io/R-C/pen/MzWeYE)