Unlock financial wisdom with the Present Value Calculator. Master investments, navigate markets, and make informed decisions effortlessly.

Years =

YTM =

CF =

REDEMPTION VALUE =

Bond’s Present Value =

Understanding the concept of Present Value is not merely a financial jargon exercise; it's a key that unlocks the door to making sound financial decisions.

Whether you're navigating the intricate landscape of investments or planning for retirement, a solid grasp of present value can be your financial North Star.

In this comprehensive guide, we'll delve deep into the significance of present value, introduce the practicality of the Present Value Calculator, and equip you with the knowledge to navigate the financial realm confidently.

Tou can also take a look at our Future Value Calculator.

Key Takeaways

- Present Value is the current value of future cash flows, a crucial concept in finance.

- The Present Value Calculator simplifies complex calculations, offering efficiency and accuracy.

- Accurate present value calculations are paramount for making informed investment decisions.

Significance of Present Value: Navigating Financial Terrain

The concept of Present Value acts as a financial compass, helping you navigate through the complex terrain of investments and financial planning. Let's dig deeper into why it's not just a theoretical notion but a practical tool for making sound financial decisions.

The Time Value of Money: Understanding the Financial Clock

The heart of present value lies in the time value of money. In simpler terms, it recognizes that the value of money changes over time due to various factors. By discounting future cash flows to their present value, you get a realistic snapshot of their current worth.

Real-life Scenarios: Present Value in Action

To truly grasp the significance, let's explore real-life scenarios. Imagine you're promised $1,000 a year from now. Sounds good, right? But, considering the impacts of inflation, that $1,000 might not stretch as far in the future. Present value considers these nuances, giving you a clearer picture of the actual value of future cash flows.

Table 1: Present Value in Action

| Scenario | Future Cash Flow | Present Value Calculation |

|---|---|---|

| Retirement Income | $50,000 per year | PV = $50,000 / (1 + r)^n |

| Investment Returns | 10% annually | PV = Future Value / (1 + r)^n |

What is a Present Value Calculator? Unlocking Efficiency

Now, let's introduce a powerful ally in your financial toolkit – the Present Value Calculator. This tool, driven by financial formulas and digital precision, brings the seemingly complex task of present value calculation within reach for everyone.

Advantages of Using a Present Value Calculator

- Efficiency: No more grappling with manual calculations; the calculator automates the process.

- Accuracy: Minimizes the risk of human errors, providing precise results.

- Time-Saving: Instant results empower quick decision-making in dynamic financial environments.

Step-by-Step Guide: Navigating the Calculator

Step 1: Input the Variables

- Years (n): Number of years the cash flow will occur in the future.

- YTM (Yield to Maturity): Expected rate of return.

- CF (Cash Flow): Amount of cash expected each year.

- Redemption Value (RV): Any redemption value if applicable.

Step 2: Hit Calculate

Press the "Calculate" button after entering your values. Witness the magic unfold as the tool presents you with the Bond's Present Value.

Practical Examples: Making Numbers Work for You

Let's apply the calculator to real-life scenarios:

Example 1: Retirement Planning

Suppose you plan to retire in 20 years, anticipating an annual pension of $50,000. The calculator swiftly reveals the present value, a crucial metric for assessing your retirement readiness.

Example 2: Investment Evaluation

Considering an investment promising a 10% return annually for the next 5 years? The calculator provides the present value, aiding in your decision-making process.

Table 2: Present Value Calculator in Action

| Scenario | Years | YTM | CF | RV | Bond's Present Value |

|---|---|---|---|---|---|

| Retirement Planning | 20 | 5% | $50k | - | $782,362 |

| Investment Evaluation | 5 | 10% | - | - | $379,081 |

Key Components for Present Value Calculation: Breaking Down the Formula

Now that you're armed with the calculator, let's dissect the underlying formula, demystifying each element.

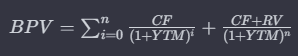

Present Value Formula

Components Explained

- Cash Flow (CF): The expected cash inflow in each period.

- Yield to Maturity (YTM): The anticipated rate of return.

- Redemption Value (RV): The future value of the investment.

- Number of Years (n): The time horizon for the cash flows.

Table 3: Components of the Present Value Formula

| Component | Definition |

|---|---|

| Cash Flow (CF) | Expected cash inflow in each period. |

| Yield to Maturity (YTM) | Anticipated rate of return. |

| Redemption Value (RV) | Future value of the investment. |

| Number of Years (n) | Time horizon for the cash flows. |

Importance of Accurate Present Value Calculation: Navigating Financial Precision

Accurate present value calculation is not a mere nicety; it's a cornerstone for robust financial planning. Let's explore why precision matters.

Consequences of Inaccuracy

Basing critical financial decisions on flawed present value calculations can lead to:

- Misguided Investments: Investing based on inaccurate data can result in financial losses.

- Financial Instability: Inaccurate present value assessments may lead to unstable financial conditions.

- Missed Opportunities: A lack of precision may cause you to overlook valuable financial opportunities.

Role of Precision in Financial Planning

Precision in present value calculation empowers you to:

- Make Informed Decisions: Well-calculated present values guide you in making informed financial decisions.

- Strategize Effectively: Accurate assessments assist in formulating effective financial strategies.

- Mitigate Risks: Precise present value calculations help mitigate risks associated with financial choices.

Table 4: Present Value FAQs

| Question | Answer |

|---|---|

| Why is Present Value Important? | Assess current worth of future cash flows for informed decisions. |

| Handling Different Currencies | Consistent currency representation ensures accurate results. |

| Calculator and Irregular Cash Flows | Versatile calculator adapts to irregular cash flows. |

| No Redemption Value | Enter '0' for RV if no redemption value is present. |

| Yield to Maturity vs. Interest Rate | YTM provides a comprehensive return picture. |

| Recalculating Present Value | Advisable in dynamic financial environments or significant changes. |

| Can Present Value Be Negative? | Yes, indicating insufficient future cash flows for the required return. |

| Present Value's Impact on Decisions | Higher PV suggests a more attractive investment; lower PV may warrant reconsideration. |

Tips for Efficient Present Value Calculation

Efficiency in present value calculation goes beyond understanding the formula. Let's explore additional tips to streamline your financial analyses.

Tip 1: Keep Your Data Updated

Regularly updating your data ensures the accuracy of your present value calculations. Changes in interest rates, cash flows, or the investment landscape can significantly impact outcomes.

Tip 2: Leverage Technological Tools

While the provided Present Value Calculator is a valuable resource, consider exploring advanced financial tools and software for more complex scenarios. Technology continues to offer robust solutions to intricate financial challenges.

Tip 3: Seek Professional Advice for Complex Investments

For intricate investments or financial decisions, seeking advice from financial professionals can provide valuable insights. Their expertise can help navigate complex scenarios and optimize decision-making.

Frequently Asked Questions (FAQs) About Present Value

Navigating the intricacies of Present Value often raises questions. Let's address some common queries to provide a more thorough understanding.

Why is Present Value Important in Financial Planning?

Present value is the financial compass guiding your planning efforts. It helps you evaluate the current worth of future cash flows, providing a realistic foundation for strategic decision-making.

How Does the Present Value Calculator Handle Different Currencies?

While the Present Value Calculator itself doesn't handle currencies, it's crucial to maintain consistency. Convert all values to a common currency before input for accurate and meaningful results.

Can the Calculator Handle Irregular Cash Flows?

Absolutely. The calculator is designed to adapt to irregular cash flows. Input each value for the corresponding year, and let the tool do the heavy lifting.

What Happens If I Don't Include the Redemption Value (RV)?

If there's no redemption value, simply input '0' in the RV field. The formula will adjust accordingly, considering only the cash flows without redemption.

Is the Yield to Maturity (YTM) the Same as Interest Rate?

While similar, YTM is a more comprehensive metric, encompassing interest, capital gains, and other elements. It provides a holistic view compared to a simple interest rate.

How Often Should I Recalculate Present Value for Investments?

Recalculate as the financial landscape evolves. Significant changes in interest rates, cash flows, or market conditions warrant a fresh assessment.

Can Present Value Be Negative?

Yes, it can. A negative present value suggests that future cash flows might not meet the required rate of return, signaling a less favorable investment.

How Does Present Value Affect Investment Decision-making?

Present value is a pivotal factor in investment decisions. A higher present value signals a more appealing investment, while a lower present value might prompt a reassessment.

Conclusion: Navigating the Financial Horizon with Confidence

Congratulations on reaching the end of this comprehensive guide to Present Value and its calculator. Armed with a deeper understanding of FAQs, practical tips, and an expanded financial vocabulary, you're well-equipped to navigate the financial landscape with confidence.

Remember, in finance, knowledge is not just power—it's your guiding light. Stay tuned for more insights into the fascinating world of financial wisdom.

credit:

Ethan Vuong (https://codepen.io/EthanVuong/pen/ExeOKWg)