Use this Amortization Calculator to empower financial planning with clear loan repayment schedules. Make informed decisions effortlessly.

Welcome to NoverInformer, your go-to resource for unraveling the complexities of financial tools. In this guide, we’ll delve into the fascinating realm of amortization and introduce you to the indispensable Amortization Calculator.

Whether you’re a homeowner, prospective borrower, or just keen on mastering financial planning, this article promises a deep dive into amortization’s intricacies and the practical utility of the calculator.

What is Amortization?

Amortization is a financial strategy that entails the gradual reduction of a debt over time through scheduled payments. It’s essentially a method of paying off a loan or mortgage, ensuring both principal and interest are covered in regular installments. The goal is to create a systematic repayment plan that spans the agreed-upon term.

What is an Amortization Schedule?

An amortization schedule acts as the roadmap for your loan repayment journey. This detailed table outlines each periodic payment, breaking down the allocation between principal and interest. Let’s visualize this with a table:

Loan Repayment Snapshot:

Assuming actual figures for the first few payments:

| Payment | Principal | Interest | Total Payment | Remaining Balance |

|---|---|---|---|---|

| 1 | $1,073.64 | $322.36 | $1,395.00 | $199,677.64 |

| 2 | $1,075.26 | $321.74 | $1,397.00 | $199,352.38 |

| … | … | … | … | … |

| n | $Xn | $Yn | $Zn | $0 (Fully Paid) |

This table provides a snapshot of each payment’s components, offering clarity on your financial commitment.

How do you calculate amortization?

While the underlying math can be intricate, the Amortization Calculator simplifies the process. Let’s explore the step-by-step calculation using the calculator.

How Can You Calculate an Amortization Schedule on Your Own?

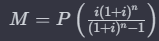

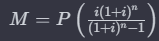

Before jumping into the calculator, understanding the manual calculation basics is beneficial. The formula for monthly payment (M) is:

Now, let’s see how the Amortization Calculator automates this process.

How do I calculate monthly mortgage payments?

The Amortization Calculator transforms monthly mortgage payment calculations into a seamless process. Here’s a detailed guide:

1. Access the Calculator:

- Visit NoverInformer and locate the Amortization Calculator.

- Ensure you have essential loan details at hand.

2. Enter Loan Details: Input loan principal, down payment details, and the annual interest rate.

3. Choose Term Type: Decide if the loan term is in years or months.

4. Review and Click Calculate: Double-check details and hit “Calculate.”

5. Receive Results: The calculator displays your monthly payment, offering a clear financial snapshot.

The Monthly Mortgage Payment Formula

Understanding the formula empowers you to make informed decisions. Let’s break it down further:

- ( M ): Monthly payment

- ( P ): Loan principal

- ( i ): Monthly interest rate

- ( n ): Total number of payments

The Amortization Calculator ensures accuracy and efficiency in applying this formula.

How to Calculate Amortization with an Extra Payment

Life’s unpredictability may lead to extra funds. The Amortization Calculator accommodates this. Here’s a guide to calculating amortization with an extra payment:

- Run Initial Calculation: Follow steps for regular amortization.

- Determine Extra Payment: Decide on frequency and amount of extra payments.

- Recalculate with Extra Payments: Input details into the calculator. Click “Recalculate” to see the impact.

- Visualize Results:

- Updated amortization schedule illustrates extra payments’ positive influence.

Mortgage Amortization Isn’t the Only Kind

While mortgage amortization is common, it extends to various financial contexts. Car loans, personal loans, and business loans all undergo amortization. The principles remain the same – gradual repayment through periodic installments.

How Can Using an Amortization Calculator Help Me?

The Amortization Calculator proves invaluable for borrowers, offering several advantages:

1. Financial Planning:

- Gain a clear overview of your repayment journey.

- Plan for future expenses confidently.

2. Comparison Tool:

- Compare different loan scenarios and terms.

- Make informed decisions based on customizable inputs.

3. Visualization of Impact:

- See how extra payments influence your payoff timeline.

- Understand long-term benefits of strategic financial choices.

4. Budgeting Assistance:

- Incorporate loan payments into your monthly budget.

- Proactively plan to avoid financial strain.

How To Use The Amortization Calculator

Step 1: Set the Stage

Before you punch in numbers, envision your financial scenario. Ask yourself:

- Question: What type of loan are you considering?

- A mortgage for your dream home?

- A personal loan for that long-awaited vacation?

Great! Now, let’s move on to the next step.

Step 2: Input the Essentials

Now, it’s time to put your financial details into action. Head over to our Amortization Calculator and input the following:

- Loan Amount: The total amount you’re borrowing.

- Interest Rate: The annual interest rate attached to your loan.

- Loan Term: The duration of your loan (in months or years).

Feel the excitement building up? We’re getting closer to unraveling the magic.

Step 3: Down Payment Drama

Down payments can be a game-changer. Are you opting for a percentage of the total or a lump sum? Choose wisely and proceed.

- Question: What’s your down payment strategy?

- Going with a percentage?

- Opting for a lump sum?

Let’s keep the momentum going.

Step 4: Hit ‘Calculate’ and Voilà!

This is where the magic happens. Hit that ‘Calculate’ button, and witness the Amortization Calculator weave its spell. It unveils a detailed plan of your repayment journey, laying out monthly installments and the evolving balance between principal and interest.

Understanding the Results

- Monthly Payment: Your predictable monthly installment.

What Does Fully Amortizing Mean?

The term fully amortizing ensures complete loan repayment by the term’s end. Unlike interest-only or balloon loans, fully amortizing loans guarantee a debt-free status once the last payment is made.

How Do You Calculate Depreciation?

While amortization focuses on loan repayment, depreciation deals with allocating an asset’s cost over its useful life. Though similar, they apply to different scenarios. Depreciation is commonly associated with accounting practices.

What Other Things Are Amortized Aside from Loans?

Amortization extends beyond loans. Examples include:

- Intangible Assets: Businesses amortize patents and trademarks over their useful life.

- Insurance Premiums: Certain insurance policies amortize premiums over the coverage period.

- Deferred Financing Costs: Companies amortize costs associated with obtaining loans or credit.

- Discounts on Bonds: Bond discounts are often amortized over the bond’s life.

Understanding the broader applications provides a holistic view of amortization’s significance.

Next Steps in Paying Off Your Mortgage

Congratulations on grasping amortization and utilizing the Amortization Calculator. Let’s explore what comes next in your financial journey.

Should I Pay Off My Loan Early?

Deciding to pay off a loan early involves considering factors such as interest rates, financial goals, penalties, and your emergency fund. Evaluate these aspects before making a decision.

Paying Off a Loan Over Time

Paying off a loan over time requires consistency and discipline. Practical tips include automating payments, wise budgeting, maintaining an emergency fund, and regular financial reviews.

Spreading Costs

Spreading costs over time through amortization provides a structured approach to managing financial obligations. Whether it’s a home, car, or business investment, understanding amortization empowers informed decisions.

In conclusion, the Amortization Calculator stands as a valuable tool in navigating loan repayment complexities. NoverInformer aims to enhance your financial literacy, guiding you on your path to financial well-being.

Frequently Asked Questions (FAQ) About Amortization and the Calculator

What is amortization, and why is it important?

Amortization is the gradual repayment of a loan through periodic payments, combining both principal and interest. It’s important because it provides a systematic way to pay off debts over time, making financial planning more manageable.

How does the Amortization Calculator work?

The Amortization Calculator simplifies complex loan calculations. Users input details like principal, interest rate, term, and it generates a comprehensive schedule.

Let’s break down its functionality with a table:

| Input | Explanation |

|---|---|

| Principal | The loan amount you borrow. |

| Interest Rate | The annual interest rate on the loan. |

| Term | The duration of the loan in either years or months. |

| Down Payment | A lump sum or percentage paid initially (if applicable). |

Output:

The calculator provides a detailed schedule, showcasing monthly payments, principal and interest portions, and the outstanding balance.

Can I use the calculator for different types of loans?

Yes, the Amortization Calculator is versatile and suitable for various loans, including mortgages, car loans, and personal loans. Its adaptability makes it a powerful tool for diverse financial scenarios.

What is the significance of an amortization schedule?

An amortization schedule plays a crucial role as a roadmap for loan repayment. It provides a detailed breakdown of each payment throughout the loan term, offering transparency and valuable insights into the composition of every installment. This transparency aids borrowers in visualizing how their money is allocated, facilitating better financial planning and decision-making.

Example:

Consider the following example of an amortization schedule:

| Month | Payment | Principal | Interest | Remaining Balance |

|---|---|---|---|---|

| 1 | $1,073.64 | $322.36 | $751.28 | $199,677.64 |

| 2 | $1,073.64 | $324.34 | $749.30 | $199,353.30 |

| … | … | … | … | … |

| 360 | $1,073.64 | $1,070.68 | $2.96 | $0 |

In this example, each row represents a monthly payment. The “Payment” column denotes the total amount paid, while “Principal” and “Interest” specify the portions allocated to repaying the loan and covering interest, respectively. The “Remaining Balance” column indicates the outstanding loan balance after each payment.

This visual representation helps borrowers comprehend the gradual reduction of the loan balance and the increasing contribution towards principal over time. By clearly illustrating the financial dynamics of each payment, an amortization schedule empowers borrowers to make informed decisions and gain a comprehensive understanding of their loan obligations.

How does making extra payments impact my loan repayment?

Making extra payments towards your loan can have a substantial impact on the overall repayment process. This proactive approach accelerates the payoff timeline and results in a significant reduction in the total interest paid over the life of the loan.

Visualization:

To better understand the impact of making extra payments, let’s compare a table displaying the original amortization schedule with one that incorporates additional contributions. This visualization will highlight the tangible benefits of strategically allocating extra funds towards your loan.

Original Amortization Schedule:

| Month | Payment | Principal | Interest | Remaining Balance |

|---|---|---|---|---|

| 1 | $1,073.64 | $322.36 | $751.28 | $199,677.64 |

| 2 | $1,073.64 | $324.34 | $749.30 | $199,353.30 |

| … | … | … | … | … |

| 360 | $1,073.64 | $1,070.68 | $2.96 | $0 |

Amortization Schedule with Extra Payments:

Assuming an extra payment of $100 each month:

| Month | Payment | Extra Payment | Total Payment | Principal | Interest | Remaining Balance |

|---|---|---|---|---|---|---|

| 1 | $1,073.64 | $100.00 | $1,173.64 | $322.36 | $751.28 | $199,355.28 |

| 2 | $1,073.64 | $100.00 | $1,173.64 | $328.26 | $745.38 | $199,027.02 |

| … | … | … | … | … | … | … |

| 260 | $1,073.64 | $100.00 | $1,173.64 | $1,014.86 | $158.78 | $98,815.11 |

| 261 | $1,073.64 | $100.00 | $1,173.64 | $1,018.94 | $154.70 | $97,796.17 |

| … | … | … | … | … | … | … |

| 360 | $1,073.64 | $100.00 | $1,173.64 | $1,070.68 | $2.96 | $0 |

In this example, an extra payment of $100 each month accelerates the loan repayment. The “Remaining Balance” decreases more rapidly, shortening the loan term and substantially reducing overall interest payments. This visualization demonstrates the financial benefits of incorporating extra payments into your loan repayment strategy.

Is the Amortization Calculator suitable for business loans?

Absolutely. The calculator’s adaptability makes it suitable for various loan types, including business loans. It accommodates different terms and structures, providing businesses with a valuable financial planning tool.

What is a fully amortizing loan?

A fully amortizing loan is one that, by the end of its term, will have repaid both principal and interest in full. It ensures the borrower becomes debt-free upon completion.

How does depreciation differ from amortization?

While both concepts allocate costs over time, depreciation applies to tangible assets in accounting. In contrast, amortization focuses on loan repayment or the allocation of costs for intangible assets.

Can I use the Amortization Calculator for non-mortgage scenarios?

Certainly. The calculator’s versatility extends to any scenario involving loan repayment. Whether it’s a car loan, personal loan, or business loan, it’s a comprehensive financial planning tool.

Should I pay off my loan early?

Deciding to pay off a loan early involves considering factors like interest rates, financial goals, and potential penalties. A personalized analysis using the Amortization Calculator can guide this decision.

In Conclusion

In conclusion, our Amortization Calculator is an awesome tool designed to enhance your financial planning experience.

It goes beyond simple calculations, providing users with a clear visual representation of their loan repayment journey.

By simplifying complex concepts and offering versatility across various loan types, this calculator empowers users to make informed decisions about their financial future.

As you explore the world of amortization and loan repayment, NoverInformer remains committed to providing valuable insights and tools to elevate your financial literacy.

Should you have additional questions or need further assistance, our FAQs are readily available, and our financial experts are here to help. Happy financial planning.

credit:

by Oliver Fleener (https://codepen.io/oliverfleener/pen/boEgYe)