Calculate simple interest and end balance effortlessly. Get instant results with this Simple Interest Calculator

Simple Interest Calculator: A Comprehensive Guide

In the realm of personal finance, understanding the basics of interest is crucial. Whether you’re planning to invest, borrow, or simply save, having a grasp of concepts like simple interest can make a significant difference.

In this article, we’ll delve into the world of simple interest, exploring its formula, benefits, and how a Simple Interest Calculator can be a valuable tool in financial decision-making.

What is Simple Interest?

Simple interest is a straightforward method for calculating the interest on a principal amount over a defined period. Unlike compound interest, which accumulates interest on both the principal and previously earned interest, simple interest only considers the initial amount.

Simple Interest Formula

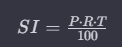

The formula for simple interest is expressed as:

Simple Interest (SI) = (P * R * T) / 100

Where:

- ( P ) is the principal amount.

- ( R ) is the rate of interest.

- ( T ) is the time in years.

Simple Interest Calculated Using Years

To calculate simple interest using years, you can use the formula mentioned above. Let’s break it down with a real-world example:

Example:

Suppose you have a principal amount (( P )) of $1000, an interest rate (( R )) of 5%, and a time period (( T )) of 3 years. Plugging these values into the formula:

SI = (1000 * 5 * 3) / 100 = $150

So, the simple interest accrued over three years would be $150.

Simple Interest for Different Frequencies

Simple interest is typically calculated annually, but it’s essential to note that some scenarios might involve different compounding frequencies, such as quarterly or monthly.

In such cases, the formula adapts to consider the frequency of compounding.

However, for our Simple Interest Calculator, we’ll focus on the standard annual calculation.

Benefits of a Simple Interest Calculator

Before we explore the intricacies of calculating simple interest, let’s understand why having a Simple Interest Calculator at your fingertips can be immensely beneficial.

- Efficiency: Manually computing interest can be time-consuming, especially when dealing with complex financial situations. A calculator streamlines the process, providing quick and accurate results.

- Accuracy: Human error is inevitable, but a calculator minimizes the risk of miscalculations. This is crucial when dealing with financial matters where precision is paramount.

- Scenario Planning: A calculator allows you to explore different scenarios by adjusting variables such as principal, interest rate, and time. This empowers you to make informed financial decisions.

Simple Interest Examples

To further illustrate the utility of the Simple Interest Calculator, let’s delve into a few practical examples.

Example 1: Savings Account

Suppose you deposit $5000 into a savings account with an annual interest rate of 3%. After two years, you can use the Simple Interest Calculator to determine the accrued interest.

SI = (5000 * 3 * 2) / 100 = $300

Example 2: Loan Repayment

Imagine you borrow $2000 at an annual interest rate of 7%. After one year, the interest accrued can be calculated as follows:

SI = (2000 * 7 * 1) / 100 = $140

Now that we’ve established the practicality of a Simple Interest Calculator, let’s explore the variations of the simple interest formula and how they can be applied in different financial contexts.

Variations of the Simple Interest Formula

While the basic formula serves well in many scenarios, variations of the simple interest formula cater to specific situations. These variations may account for changes in compounding frequency or adjustments in the way interest is calculated. Let’s briefly touch upon a couple of these variations:

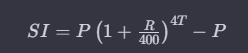

- Simple Interest for Quarterly Compounding:

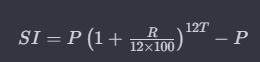

- Simple Interest for Monthly Compounding:

Understanding these variations expands the applicability of the simple interest concept in various financial scenarios.

How to Calculate Simple Interest Using this Calculator?

Now that we’ve laid the foundation for understanding simple interest let’s explore how you can utilize the provided Simple Interest Calculator to streamline your calculations.

Step-by-Step Guide:

- Enter Principal Amount (P): Input the initial amount of money.

- Enter Interest Rate (R): Specify the annual interest rate as a percentage.

- Enter Time (T): Indicate the time period in years.

- Click Calculate: Hit the “Calculate” button to compute the simple interest.

- Reset Fields (Optional): Use the “Reset Fields” button to clear the inputs and start afresh.

Now, let’s take a closer look at the calculator and its features:

Simple Interest Calculator Interface:

The calculator provides a user-friendly interface with clearly labeled input fields for the principal amount, interest rate, and time.

The “Calculate” button initiates the computation, and the “Reset Fields” button conveniently clears the inputs for a new calculation.

How Can this Simple Interest Calculator Help You?

Scenario Planning:

Whether you’re saving for a goal or considering a loan, the calculator allows you to experiment with different scenarios. Adjust the principal, interest rate, or time to observe the impact on simple interest.

Quick and Accurate Results:

Eliminate the risk of manual errors and save time by obtaining precise simple interest calculations with just a few clicks.

Informed Financial Decision-Making:

Empower yourself with the knowledge of how interest accrues over time. This tool aids in making informed decisions aligned with your financial goals.

What Financial Instruments Use Simple Interest?

Various financial instruments rely on simple interest calculations. Some common examples include:

- Savings Accounts: The interest earned on a savings account is often calculated using simple interest.

- Personal Loans: When repaying a personal loan, understanding the simple interest helps in planning timely repayments.

- Certificates of Deposit (CDs): Simple interest is used to determine the interest earned on CDs.

- Bonds: Certain bonds accrue interest using simple interest calculations.

Now, let’s explore the distinction between simple interest and compound interest.

Simple Interest Versus Compound Interest

Understanding the difference between simple and compound interest is crucial for making informed financial decisions.

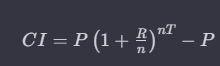

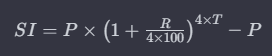

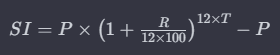

Compound Interest Formula

Compound interest takes into account the interest earned not only on the principal amount but also on the accumulated interest. The formula for compound interest is given by:

Compound Interest (CI) =

Where:

- ( P ) is the principal amount.

- ( R ) is the annual interest rate.

- ( n ) is the number of times interest is compounded per year.

- ( T ) is the time in years.

Learn More About Compound Interest

While simple interest provides a straightforward calculation, compound interest can result in higher returns due to the compounding effect. Understanding the nuances of compound interest is essential for long-term financial planning.

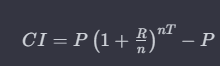

Compound Interest Formula Revisited

Let’s revisit the compound interest formula to reinforce the distinction between simple and compound interest:

Compound Interest (CI) =

Table: Simple vs. Compound Interest Comparison

| Aspect | Simple Interest | Compound Interest |

|---|---|---|

| Calculation |  | CI = P (1 + R /n)nT – P |

| Impact of Time | Linear growth over time | Exponential growth over time |

| Frequency of Growth | Annual | Can be quarterly, monthly, etc. depending on ( n ) |

| Return on Interest | Constant throughout the period | Compounds, leading to higher returns over time |

Understanding the differences between simple and compound interest is essential for making informed decisions about savings, investments, and loans.

Which is Better for You: Simple or Compound Interest?

The choice between simple and compound interest depends on your financial goals and the specific instrument you’re dealing with.

- Simple Interest: Ideal for straightforward scenarios where interest is calculated once annually, such as basic savings accounts or short-term loans.

- Compound Interest: More advantageous for long-term investments or savings where interest compounds regularly, potentially leading to higher returns.

Consider your financial objectives and the nature of the financial instrument to determine which interest method aligns best with your goals.

Exploring Simple Interest: Real-Life Examples and In-Depth Scenarios

In this section, we’ll delve deeper into real-life examples and explore more scenarios to enhance your understanding of simple interest. Additionally, we’ll address common questions and concerns to provide a comprehensive guide to using the Simple Interest Calculator effectively.

Simple Interest Examples: Real-Life Scenarios

Example 1: Mortgage Interest

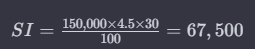

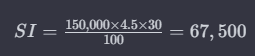

Consider a scenario where you’ve taken out a mortgage of $150,000 with an annual interest rate of 4.5%. The loan term is 30 years. Using the Simple Interest Calculator:

Inputs:

- Principal Amount (P): $150,000

- Interest Rate (R): 4.5%

- Time (T): 30 years

Calculation:

In this example, you’d be paying $67,500 in simple interest over the 30-year period on top of the initial loan amount.

Example 2: Investment Returns

Suppose you invest $10,000 in a fixed deposit with an annual interest rate of 3%. After 5 years, you can use the Simple Interest Calculator to determine your returns:

Inputs:

- Principal Amount (( P )): $10,000

- Interest Rate (( R )): 3%

- Time (( T )): 5 years

Calculation:

Your investment would yield $1,500 in simple interest over the 5-year period.

Advanced Simple Interest: Compounding Frequencies

While the standard simple interest formula assumes annual compounding, certain scenarios involve different compounding frequencies. Let’s explore these variations using a table:

Table: Simple Interest for Different Compounding Frequencies

| Compounding Frequency | Formula |

|---|---|

| Quarterly |  |

| Monthly |  |

By adapting the formula to the frequency of compounding, you can accurately calculate simple interest in scenarios where interest is compounded more frequently than annually.

FAQs: Addressing Common Concerns

Can Simple Interest Calculators Handle Varying Interest Rates?

No, the basic simple interest formula assumes a constant interest rate throughout the specified time period. If interest rates vary, the calculations would need to be adjusted accordingly.

How Accurate Are Simple Interest Calculators?

Simple Interest Calculators provide accurate results based on the input parameters. However, it’s crucial to ensure that the calculator aligns with the specific compounding frequency and interest calculation method applicable to your scenario.

Does Simple Interest Consider Changes in Principal Amount?

No, the simple interest formula assumes a constant principal amount over the specified time period. If there are changes in the principal amount, the calculations would need to be modified accordingly.

What can I determine with the help of SI calculators?

A Simple Interest (SI) calculator allows you to determine the interest accrued on a principal amount over a specified time period. It aids in financial planning, helping you understand the impact of different variables on interest calculations.

Can I change the unit of the amount to different currencies?

The calculator provided here operates with numerical inputs. To convert currencies, you’d need to manually input the equivalent amount in the desired currency.

Do interest rates on the principal amount change over time in SI?

No, the simple interest formula assumes a constant interest rate throughout the specified time period. It does not account for fluctuations in interest rates over time.

In Conclusion: Making Informed Financial Decisions

In this comprehensive guide, we’ve explored the fundamental concepts of simple interest, from its basic formula to real-life examples and advanced scenarios. The provided Simple Interest Calculator offers a valuable tool for quick and accurate calculations, enabling you to make informed financial decisions.

As you navigate the complexities of interest calculations, remember that the choice between simple and compound interest depends on your specific financial goals and the nature of the financial instrument you’re dealing with.

Whether you’re planning a mortgage, considering an investment, or simply aiming to understand the dynamics of interest, the knowledge gained from this guide and the use of the calculator will undoubtedly enhance your financial literacy.

credit:

Imoh Etuk (https://codepen.io/imohweb/pen/ZEGXRzR)